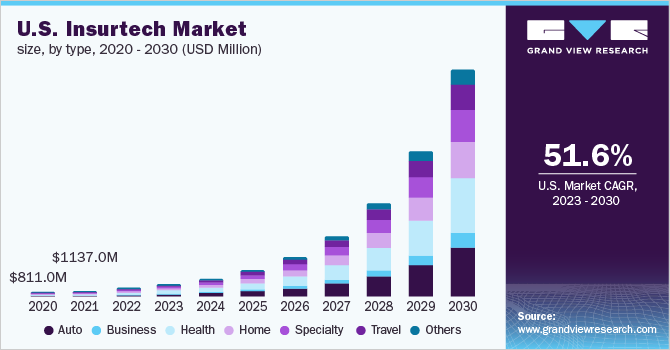

According to Grand View Research, “The global insurtech market size was valued at USD 5.45 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 52.7% from 2023 to 2030.” Take a look at how the InsurTech transition market is expected to grow segment-wise in the U.S.

As is evident from the above graph, the growth of InsurTech has been remarkable in recent years. It has revolutionized the insurance industry, attracting significant investments, and fostering a thriving ecosystem of startups and collaborations between traditional insurers and technology firms.

What led to the big boom in InsurTech? It is the emerging technologies such as digital tools, big data analytics, artificial intelligence (AI), machine learning (ML), blockchain, Internet of Things (IoT), and telematics.

These technologies have found their applications in numerous core areas of insurance, chief among them being policy issuance, underwriting, claims management, risk assessment, claims processing, fraud detection, and customer engagement. Together, they are changing the traditional insurance models by the day through data-driven approaches that allow for more accurate underwriting, improved risk assessment, and enhanced pricing models. These have resulting in more precise and competitive insurance offerings.

At the granular level, InsurTech is:

- Disrupting traditional insurance distribution channels by leveraging technology to reach customers directly through online platforms, mobile apps, and digital marketplaces. This puts power directly into the hands of the customers allowing them to compare insurance policies across providers and purchase the best-fit solutions.

- Enabling greater customization and personalization with the help of data analytics and advanced algorithms that accurately calculate individual risk profiles and help design coverage based on specific customer needs and behaviors.

- Moreover, improving the overall customer experience by simplifying policy applications, claims filing, and customer support with user-friendly interfaces, automated processes, and real-time communication channels.

- Efficiency is on the rise, thanks to advanced technologies like AI, machine learning, and natural language processing. These tools analyze large data volumes, assess risk, and enhance underwriting decisions’ speed and accuracy. In addition, automation and digital tools are simplifying claims filing and processing, enabling faster payouts and reducing the administrative burden on insurers.

- Introducing innovative risk mitigation strategies with the help of IoT devices and sensors that can collect real-time data on risks, provide insights for preventive measures thereby enabling insurers to offer usage-based or behavior-based insurance products.

As the industry continues to embrace digital transformation, InsurTech is poised for continued growth. This is reshaping the insurance landscape and providing new opportunities for insurers, wholesalers, Managing General Agents (MGAs), and customers alike.

Read more: Insurance Companies in Digital World: Opportunities & Challenges

Key Imperatives for Wholesalers & MGAs in the InsurTech Era

In the current scenario, wholesalers and MGAs play a vital role as intermediaries in the insurance industry. They are crucial for connecting retail agents with appropriate insurance solutions and assisting them in meeting their clients’ unique needs.

- Wholesalers, who specialize in placing coverage for unique, high-risk, or hard-to-insure risks by leveraging their access to specialty markets and surplus lines carriers, are in a great position to leverage InsurTech to accurately assess risks, negotiate terms with carriers, and facilitate the placement of coverage on behalf of retail agents.

- MGAs too, who act as underwriters and administrators for specific insurance programs or lines of business, have a wide array of tools and technology to choose from to design client-centric policies, personalize policy administration, and manage claims with greater swiftness.

Having Established the Unavoidability of InsurTech, It is Now Important to Aid Wholesalers and Navigate the InsurTech Transition Successfully.

To achieve this, a multi-pronged approach will be necessary, one that must address the following:

- Invest in systems modernization, new software platforms, cloud-based solutions to replace legacy systems and be compatible with modern InsurTech platforms.

- Offer essential training and support to employees. Encourage a mindset of continuous learning to overcome resistance and facilitate a successful InsurTech transition.

- Address data privacy and data protection concerns by implementing robust cybersecurity measures, including encryption, access controls, and regular security assessments.

- Partner with right InsurTech providers to access innovative solutions, expertise, and technology infrastructure. Efficiency is on the rise, thanks to advanced technologies like AI, machine learning, and natural language processing. These tools analyze large data volumes, assess risk, and enhance underwriting decisions’ speed and accuracy. Moreover, insurers can also explore new business models, expand their offerings, and tap into emerging markets.

Partner with ISW – We can Walk the InsurTech Path with You

Insurance Support World (ISW) is a leading provider of insurance back-office services and InsurTech solutions. We offer a range of services designed to support insurance companies, wholesalers, and MGAs. Our InsurTech solutions are backed by our domain expertise, quality assurance, customer focus, and commitment to data security.

Get in touch with us at [email protected] or call us at +1 646-688-2821 for our InsurTech consulting services. We guide clients:

- In understanding the InsurTech landscape, and help draw up the requirements to integrate technology solutions.

- Help leverage data effectively for actionable insights. Our insurance data analytics teams excel in data management and analytics.

- Enhance customer experience through the implementation of customer-centric digital solutions.

- Navigate regulatory compliance, provide training, and enable continuous improvement to maximize the benefits of InsurTech.