Artificial Intelligence (AI) was a term coined by emeritus Stanford Professor John McCarthy in 1955. He defined AI as “the science and engineering of making intelligent machines.”

Since then, AI has evolved into a multidisciplinary field encompassing various technologies and methodologies that simulate human-like intelligence in machines. AI in the insurance industry is one such field. It leverages advanced algorithms and data analytics to transform processes such as risk assessment, claims processing, customer service, fraud detection, and others.

Applications of AI in the insurance industry

AI in insurance is a game changer today. It has been bringing unprecedented changes to various aspects of the insurance industry. Today, AI is spearheading innovative solutions and offering insurers several levers to tighten their processes. Key applications of AI in insurance include:

-

Underwriting and risk assessment:

AI algorithms analyze large datasets to assess risks associated with insurance policies. Machine learning (ML) models, an arm of AI, identify patterns and correlations in data. This is helping insurers to make more accurate predictions. Automated insurance underwriting processes are streamlining policy issuance and are improving decision-making

-

Claims processing:

AI-powered systems are automating and expediting the claims handling process. Automated claims processing is reducing manual intervention and processing time. Then there are the Natural Language Processing (NLP) algorithms. These algorithms extract information from claim documents and set up a process that speeds up claims assessment. Today, claims processing is being also expedited by the Computer Vision technology. This technology assess damage through image analysis doing away with on-ground assessment to the extent necessary

-

Customer service and engagement:

AI in insurance has brought about virtual assistants and chatbots. These are providing personalized customer support and assistance. In addition, there are AI-driven recommendation engines and sentiment analysis. The former suggests relevant insurance products based on customer profiles and preferences. The latter is helping insurers gauge customer satisfaction and identify areas for improvement in service delivery

-

Personalized pricing:

Generative AI in insurance is also responsible for bringing about personalized pricing. AI algorithms analyze individual customer data – for example, driving behavior or health metrics — to determine personalized insurance premiums. There are also usage-based insurance (UBI) AI models that adjust premiums on the basis of real-time data. Policyholders, therefore, have access to far better pricing than before

-

Risk prevention and mitigation:

The insurance sector is making increasing use of AI-powered predictive analytics and IoT devices today. Predictive analytics identify potential risks to the company. This is helping insurers to offer proactive advice and interventions to policyholders. IoT devices, such as connected gadgets and devices in vehicles, also feed data to AI algorithms analyze to assess risks and prevent accidents

-

Fraud prevention:

AI in insurance enables fraud prevention with the help of anomaly detection algorithms. Vast amounts of data are analyzed by AI algorithms to detect unusual patterns and potential frauds. Beyond these algorithms, there are the social network analysis and data mining techniques that identify connections and correlations between entities to uncover fraudulent networks and activities

-

Product development:

AI in insurance has also been instrumental in helping insurers develop innovative insurance products. Such products are tailored to market needs and customer preferences. A new AI technology called the Natural Language Generation (NLG) technology generates personalized policy documents and communications for insurers. These are helping in improving the clarity and understanding for policyholders

-

Regulatory compliance:

Generative AI in insurance is also assisting insurers in their compliance and regulatory requirements. This they achieve by analyzing and interpreting complex legal documents and regulations. Then are the automated compliance monitoring tools that track changes in regulations and flag potential compliance issues

-

Predictive maintenance:

In commercial insurance, AI helps predict equipment failure or breakdowns for businesses. AI tools analyze data from IoT sensors to draw up the predictive maintenance chart. AI algorithms are also forecasting the likelihood of property damage or business interruption events

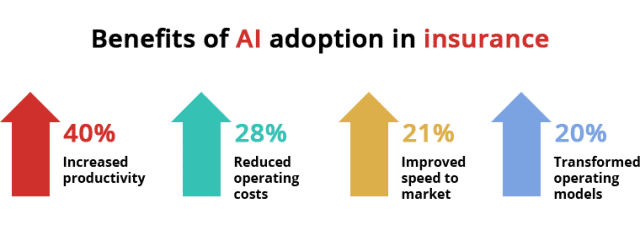

Benefits of AI adoption in insurance

According to a recent Forbes Insights survey of 300-plus executives, 95% believe that AI will play an important role in their responsibilities in the near-future. The most-cited business benefits corporate leaders see from AI include:

In the insurance industry too, the adoption of AI brings numerous benefits. These range from operational efficiencies and cost savings to enhanced risk management and customer satisfaction. The wide-ranging benefits are enumerated as follows:

- Significant improvement in process efficiencies

- Cost savings and productivity gains from resultant operating model streamlining and optimization

- Improved and pre-emptive risk management

- Faster and more personalized customer service

How insurers can prepare for AI adoption in their processes

AI in the insurance industry is here to stay. It has, therefore, become imperative to invest time and money to gauge its potential. In parallel, insurance organizations will have to upgrade their systems and teams to leverage AI technologies effectively. Insurers will have to remodel their business processes to capitalize on the opportunities AI in insurance presents.

- Stay abreast of latest AI developments specific to the insurance industry; understand in details their use cases as they evolve

- Formulate a well-thought through AI-integration strategic plan for the organization’s operations and processes. This plan should be match the insurer organization’s overall business objectives

- Data is the foundation of AI. For AI in insurance to be effective, insurers will have to put in place a strong data policy. There should be specific guidelines with respect to data collection, storage, management, and usage in advanced analytics and machine learning algorithms

- Invest in building the necessary talent pool and technology infrastructure to support AI initiatives. The hiring of data scientists, AI specialists, and other professionals with expertise in AI-related technologies should be planned. Additionally, insurers should invest in scalable and flexible technology platforms that can accommodate the growing demands of AI applications

- Collaborate with technology vendors, or business process service providers to access cutting-edge AI solutions and expertise

- Develop policies and protocols to ensure that AI technologies are deployed ethically and responsibly

Adoption of AI in the insurance industry is not just a trend, it is an imperative

According to a study by Mckinsey, As AI becomes more deeply integrated in the industry, carriers must position themselves to respond to the changing business landscape. Insurance executives must understand the factors that will contribute to this change and how AI will reshape claims, distribution, and underwriting and pricing. With this understanding, they can start to build the skills and talent, embrace the emerging technologies, and create the culture and perspective needed to be successful players in the insurance industry of the future.

This will require a tectonic shift within the organizations. Careful consideration will have to go into building the right ecosystem for AI adoption. A safe approach for beginners would be to work with insurance BPO services provider to leverage their technology infrastructure to build customized tools. This will not only save huge initial outlays, but will also hedge against unforeseen risks. A gradual scale up can happen in due time to fully realize the benefits of AI in insurance processes. As organizations understand AI’s many technologies better, they will be in a better position to take informed decisions on infrastructure spends, systems upgrades etc. In the long run, however, there is no running away from embracing AI. It is poised to be a strategic enabler. Insurers will be able to improve their competitiveness, drive innovation, and deliver greater value to their customers with the gradual adoption of AI in their insurance processes.

Talk To Our Experts