A Complete Guide to Insurance Back Office Operations

11 Jan, 2024

- Posted By:Diana Krall

Insurance back-office operations is projected to reach $24.6 billion by 2032, growing at a CAGR of 12.3% from 2023 to 2032, according to a survey by Allied Market Research.

We already know that back-office operations are the administrative functions of an organization that are vital for its functioning, but which do not directly contribute to its revenues / income. In business terms, they belong to the cost center. These functions include administrative tasks, finance and accounting, supply chain management, data management, IT support, and also legal and compliance. They are the very backbone of the organization. After all, efficient back-office operations are essential for maintaining organizational effectiveness, ensuring compliance with regulations, and for supporting overall business goals.

What Are Insurance Back Office Operations?

Insurance back-office operations, in this very context, are the administrative and support functions within insurance companies that help in their day-to-day operations. The back-office operations handle a range of tasks — policy administration, claims processing, underwriting support, regulatory compliance, finance and accounting, and legal compliance. They help their client-facing teams to sell policies, close claims, underwrite etc. An able and expert back-office team acts as a formidable foundation ensuring smooth policy management, accurate financial transactions, adherence to regulatory standards, and builds an eco-system of happy and satisfied customers.

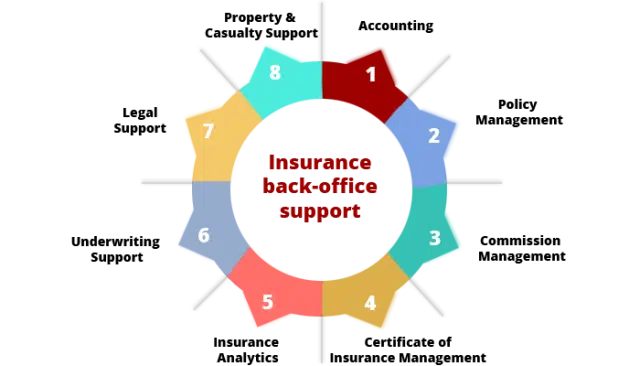

Common Insurance Back Office Support

Insurance back-office support comprises a range of administrative functions that contribute to the seamless operations of insurance companies. Here are common elements of back-office support in the insurance industry:

Accounting:

- Premium management: This includes accounting for premium collected, accurate and timely billing, and the timely processing of payments

- Claims reserving: Calculating and setting aside funds for anticipated claim payouts based on historical data and actuarial analysis

- Financial reporting: Preparing comprehensive financial statements, reports, and disclosures to comply with regulatory standards

Policy management:

- Issuance and endorsements: Creating and issuing new insurance policies, as well as processing endorsements or modifications to existing policies

- Renewals: Managing the renewal process, including premium adjustments and policy updates, to maintain accurate and up-to-date coverage

Commission management:

- Commission calculations: Accurately computing commissions based on policies sold, renewals, and other performance metrics

- Agent / Broker relations: Addressing inquiries, resolving commission-related issues, and maintaining positive relationships with agents and brokers

Certificate of Insurance management:

- Generation and distribution: Creating and issuing certificates of insurance to demonstrate coverage for policyholders, vendors, or other relevant parties

- Tracking and compliance: Monitoring and ensuring that certificates are up-to-date and compliant with contractual requirements

Insurance analytics:

- Data collection: Gathering and aggregating data from various sources, including policy information, claims data, and external market trends

- Predictive modelling: Utilizing statistical models to predict future trends, assess risk, and optimize underwriting and pricing strategies

Underwriting Support:

- Risk assessment: Collecting and analyzing information to evaluate the level of risk associated with potential policyholders or renewals.

- Documentation and Compliance: Ensuring that underwriting decisions comply with company policies, industry regulations, and legal requirements.

Legal Support:

- Contract Review: Examining insurance policies, contracts, and legal documents to ensure accuracy, compliance, and alignment with company standards.

- Dispute Resolution: Assisting in the resolution of legal issues related to claims, policy disputes, and regulatory matters.

Property & Casualty Support:

- Claims Processing: Handling claims related to property damage, liability, and other casualty events, ensuring prompt and fair settlements.

- Risk Mitigation: Implementing strategies to minimize risks associated with property and casualty coverage through effective underwriting and loss control measures.

Importance of Efficient Back Office Operations:

Efficient back-office operations play a pivotal role in the overall success and sustainability of an insurance company. Additionally, these streamlined processes contribute significantly to improved customer service and financial stability. Offshore and back-office outsourcing impact many key areas of the business. These are summarized as follows:

A positive impact on customer satisfaction:

- Timely service: Good and efficient back-office operations bring in a regime of prompt policy issuance, quick claims processing, and accurate endorsements. These lead to timely service policyholders resulting in heightened customer satisfaction

- Accuracy in transactions: Accurate premium billing, precise policy information, and error-free documentation are the chief deliverables of back-office operations. Consequently, when duly delivered, they enhance customer trust and confidence in the insurance provider.

Role in risk management and compliance:

- Data accuracy: Back-office functions, such as underwriting support and claims processing, bring about a culture of accurate risk assessment and management. The role of data integrity in effective insurance risk management is pivotal in ensuring the reliability and precision of these functions. Over a period of time, a commitment to data integrity significantly reduces the likelihood of adverse events. Additionally, it enhances overall operational efficiency and fosters a culture of trust and reliability within the organization.

- Compliance adherence: Back-office operations, by their very nature, adhere to regulatory requirements and compliance standards strictly. This mitigates legal risks and ensures that the insurance company operates within established guidelines

Cost-effectiveness and resource optimization:

- Operational efficiency: Offshore and back-office outsourcing bring about streamlined processes in the back office. This leads to cost savings through reduced operational errors, lower rework, and improved efficiency in tasks such as premium collection, claims processing, and policy management

- Optimized resource allocation: Offshored back-office operations also enable optimal allocation of both human and technological resources. This allows the organization to focus on strategic initiatives rather than having to handle day-to-day operational bottlenecks

Data security and privacy:

Back-office functions, especially in data management and IT support, are crucial for maintaining the confidentiality and privacy of sensitive customer information. These are built into their SLAs and thereby ensure 100% compliance with data protection regulations

Business agility and innovation:

An efficiently managed back office can adapt to industry changes, market trends, and technological advancements more readily, fostering business agility and the ability to innovate in response to evolving customer needs

Agent and partner relationships:

- Commission accuracy: Efficient commission management in the back office ensures accurate and timely payments to agents and brokers, fostering positive relationships and incentivizing strong performance

- Collaboration: Streamlined processes in policy issuance, endorsements, and claims management contribute to smoother collaboration with external partners, creating a more cohesive insurance ecosystem

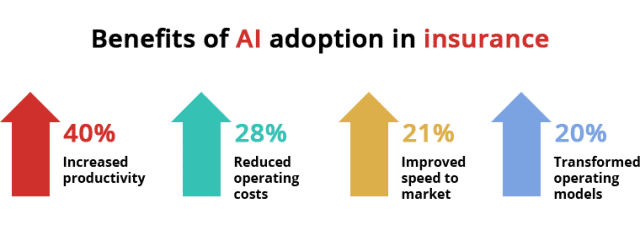

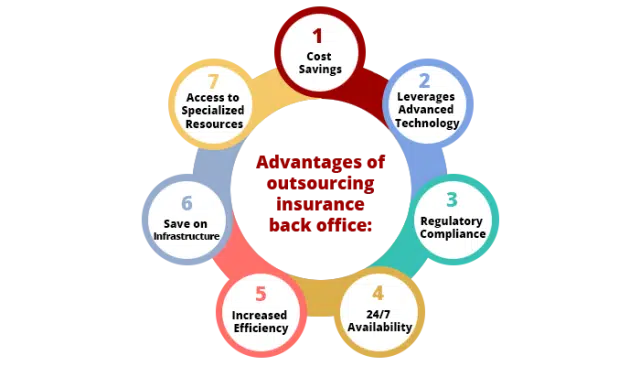

Advantages of Outsourcing Insurance Back Office

Offshoring insurance back-office operations has been helping insurance companies adopt a strategic approach towards efficiency, cost-effectiveness, and enhanced focus on their core business. By entrusting functions such as claims processing, policy management, administrative functions, finance and accounting, and legal compliance to outsourcing service providers, insurance companies have been reaping a wide array of advantages. These are summarized as follows:

- Helps avoid costly mistakes and realises significant cost savings

- Aid to reinvent your business by redefining operating models and streamlining turnaround times

- Ensures resource utilization to build the core business

- Facilitates the tapping into a global talent pool, and eliminate employee management hassles

- Brings about 24/7 availability

- Enhances scalability, innovation and flexibility, and ensures business continuity

- Leverages advanced technology solutions at reduced rates

- Facilitates regulatory compliance and improves quality standards

- Makes room for tailored and customized solutions thereby improving customer service

Outsource your Insurance Back Office Operations

Offshore and back-office outsourcing in India has been popular for many decades now. Global organizations have increasingly been outsourcing back-office support to India, aiming to achieve their overarching objectives of cost efficiency, resource optimization, and long-term growth.

Consider outsourcing your insurance back office services to Insurance Support World (ISW). We bring a wealth of experience, industry expertise, and commitment to operational excellence. We work as our clients’ partner, offering comprehensive solutions across all sub-functions of insurance, and continuous support to ensure the good health of the operations outsourced. Our professionally qualified staff, along with our expert IT team who are adept at advanced technologies and data analytics, make ISW an ideal back-office / outsourcing partner for insurance organizations that are seeking better productivity, optimized costs, and flexibility and skills to handle market challenges.