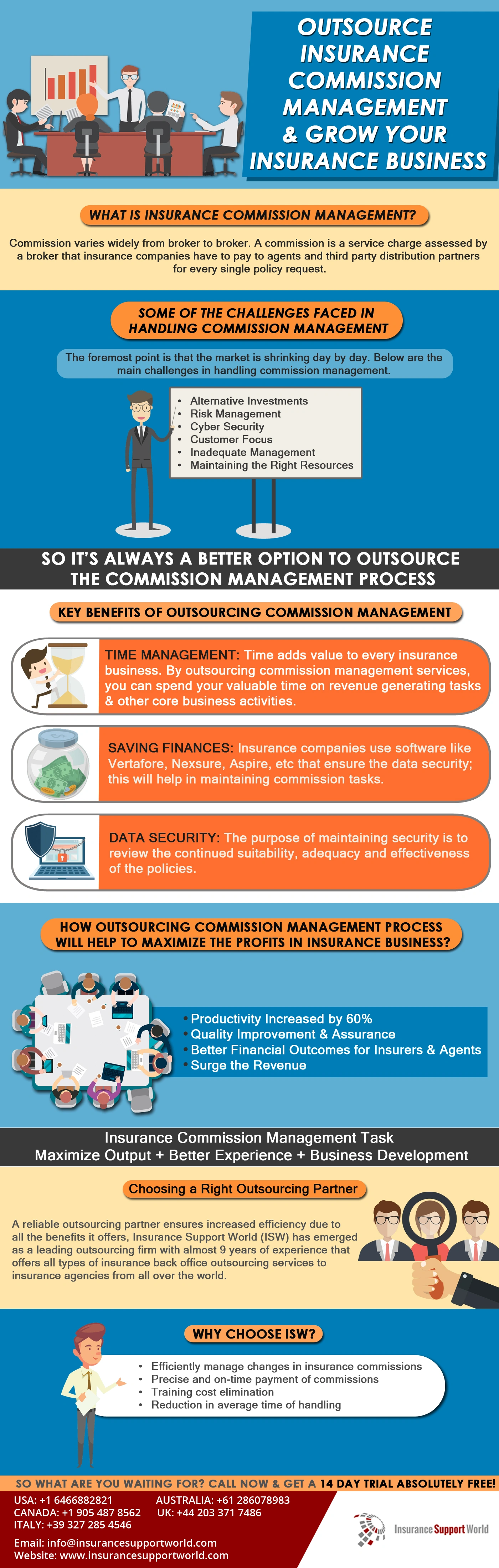

Outsourcing commissions management has become an essential aspect for insurers. Managing commissions for a wide network of agents becomes complex. This is because you need to be attentive to details as it may cause losses.

Insurers often face numerous challenges when handling commission management in-house, such as alternative investments, risk management, improper resources, etc. So, the best way to overcome these challenges is to opt for outsource commission management services. They offer innumerable benefits to insurers, which are as follows:

-

Expertise:

Specialized commission management firms have extensive experience and expertise in handling insurance commissions. They understand the intricacies of commission calculations, tracking, and payment processes.

-

Accuracy

Commission calculations can be complex and prone to errors if done manually. Outsourcing ensures accurate and error-free commission calculations, reducing disputes and discrepancies.

-

Efficiency

Outsourcing the commission management process helps to save time and resources. This lets your in-house staff focus on core business activities rather than administrative tasks.

-

Cost Savings

Outsourcing eliminates the need for hiring and training additional staff to manage commissions. It also reduces the costs associated with commission calculation software and systems.

-

Scalability

Commission management needs may fluctuate with business growth. Outsourcing provides scalability, allowing you to handle commission volume changes without disruptions easily.

-

Compliance

Commission management firms have complete knowledge of industry regulations and compliance requirements. They can ensure that your commission processes adhere to legal standards.

-

Timeliness

Outsourcing ensures timely commission payments to agents and brokers, improving relationships and trust with your distribution network.

-

Enhanced Reporting:

Commission management providers often offer robust reporting and analytics tools, giving you insights into your commission expenses and helping you make data-driven decisions.

-

Focus on Core Business:

By outsourcing commission management, you can redirect your resources and attention to developing and expanding your insurance business, rather than getting bogged down in administrative tasks.

-

Reduced Risk:

Commission disputes and inaccuracies can lead to legal and reputational risks. Outsourcing reduces these risks by ensuring accurate and compliant commission management.

-

Access to Technology:

Commission management firms typically use advanced software and technology, providing you with access to cutting-edge tools without the need for significant investments in technology infrastructure..

With the right outsourcing partner, you can maximize the business profits and reduce operational costs by up to 60%. As your commission management process is streamlined, it will achieve success in the long-run.