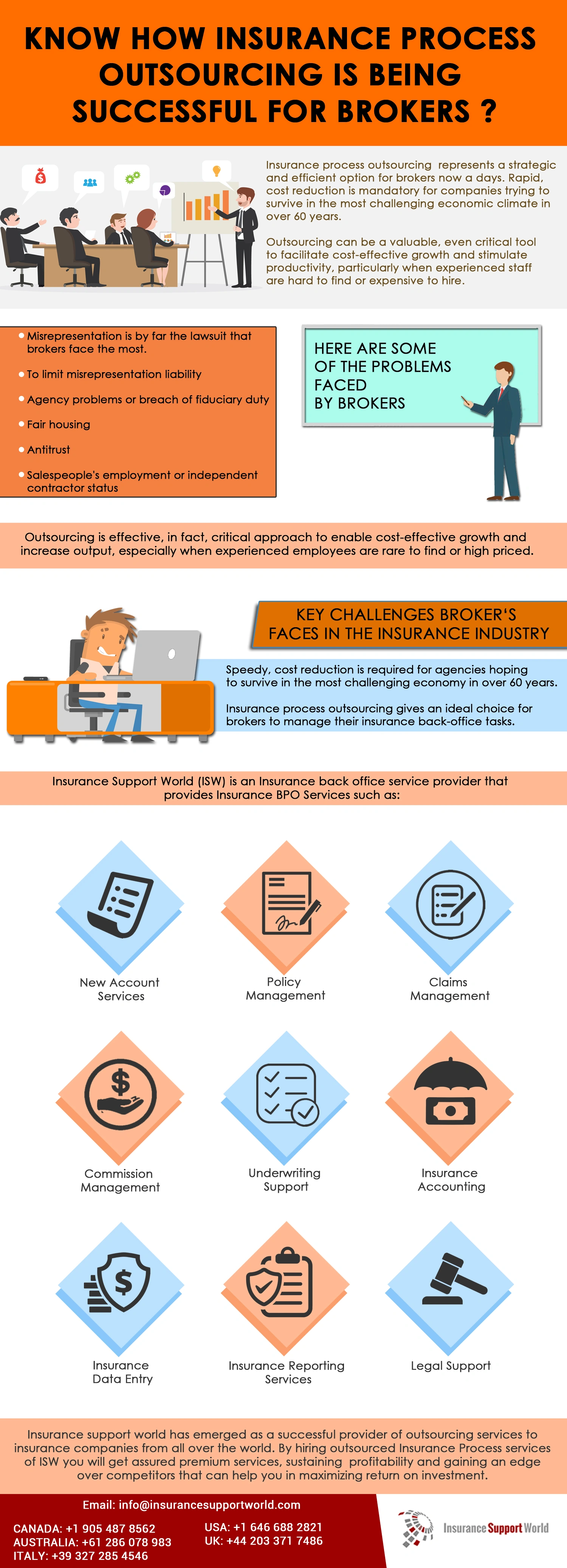

Insurance outsourcing services have become increasingly successful for insurance brokers in today’s dynamic and competitive market. As brokers face evolving customer demands, regulatory changes, and technological advancements, they turn to insurance outsourcing services. It helps them gain a competitive edge and streamline their operations. Insurance broker services outsourcing helps brokers save time and resources. Administrative tasks, such as policy management, data entry, and document processing, can be labor-intensive. By delegating these responsibilities to specialized outsourcing providers, brokers can free up valuable time and human resources to focus on their core activities, like building client relationships and providing expert insurance advice.

Furthermore, outsourcing enhances the efficiency and accuracy of insurance operations. Outsourcing partners have the expertise and technological tools to ensure that tasks are executed swiftly and accurately. This leads to faster policy issuance, claims processing, and other critical functions, ultimately improving the overall client experience.

Insurance brokers also benefit from outsourcing in terms of cost savings. Maintaining in-house teams for various tasks can be expensive. Outsourcing providers often operate in cost-effective locations and can deliver high-quality services at a fraction of the cost, enabling brokers to reduce operational expenses without compromising on service quality.

In today’s digital age, staying technologically competitive is crucial. Insurance outsourcing services frequently provide access to advanced technology and data analytics. Brokers can leverage these capabilities to stay updated with the latest industry trends, enhance data-driven decision-making, and offer clients more personalized insurance solutions.

Another vital aspect is compliance and regulatory adherence. Keeping up with ever-changing insurance regulations is a complex and time-consuming task. Outsourcing partners have the expertise to navigate this regulatory landscape, ensuring that brokers remain compliant and avoid costly penalties or legal complications.

Overall, insurance outsourcing services broker has proven to be a successful strategy for brokers to stay agile, cost-efficient, and client-focused in the modern insurance industry. It allows brokers to concentrate on their core competencies, improve service quality, reduce operational costs, and remain competitive in a rapidly evolving marketplace.

How Insurance Broker Services can Help you?

Choose Us for High-quality Insurance Outsourcing Services

Get a competitive edge for insurance business today, by opting for insurance process outsourcing services. Moreover, you will receive numerous benefits that will change the way your business functions. Insurance Support World is one of the top-notch insurance outsourcing company that provide an array of insurance outsourcing services. Be it new business, policy management, claims management, commission management or more.