The insurance sector has seen a notable rise in cyberattacks in the past two years. Cybercriminals or spammers know that insurers collect, store, and use their policyholders’ personal information in large amounts. This is one of the biggest reasons why the sector is highly vulnerable to cyberattack attempts and seeing a rise in insurance cybersecurity trends.

Some of the more recent, essential changes in the insurance cybersecurity marketplace include:

- Reduced capacity: Insurance carriers do not prefer offering much coverage because they know it is highly possible to pay that amount.

- Underwriting scrutiny: Underwriters have moved ahead of indulging in your IT team. They are asking questions about controls, and if they consider you high-risk, they may not offer you coverage.

- Rate increases: Insurers are witnessing 25% to 100% rate growth for higher, more routine losses.

Just applying for cyber insurance has evolved. Insurance companies have improved their application questionnaires to understand whether a company is at stake for ransomware or any other kind of cyberattack. Carriers use these yes/no questionnaires to score applicants, set insurance rates, and decide whether they will offer a policy at all.

Also Read: Insurance Companies in Digital World: Opportunities & Challenges

Since new cyber threats are emerging fast, insurance businesses must monitor all transactions and detect unauthorized and unusual activities. Besides, they need to update their security systems from time to time to safeguard company and customer data against cyberattacks.

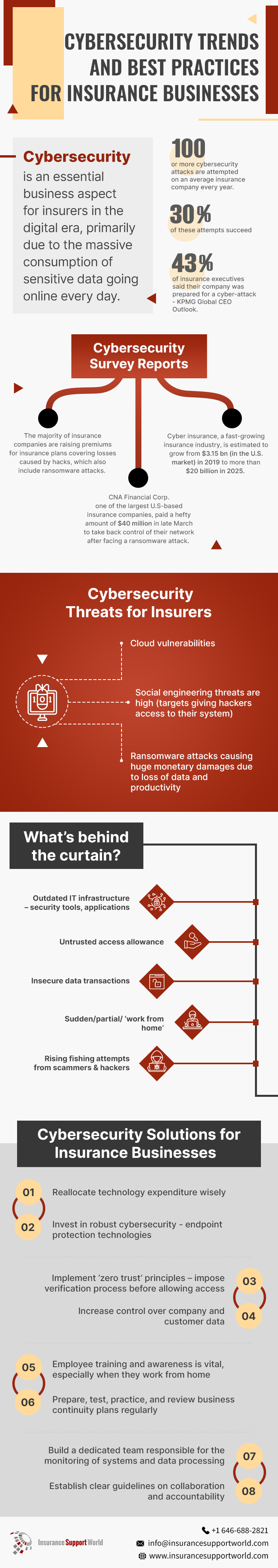

To learn more about insurance cybersecurity topic, let’s go through the infographic below:

To know more write to us at [email protected] or dial at +1 646 688 2821.